My simple "Cash Harvesting" Strategy

Could Multiply Your Net Worth by

Over 350% – Even in the Comatose

Market of the Next 9 Years

Dear American Dreamer,

I'm Martin Hutchinson. And unlike a lot of TV pundits, I'm not going to hold your hand and tell you everything will soon be A-OK in the U.S. of A...

Because the truth is – for 99% of Americans, it won't be.

That's because they believe in politicians who blow sunshine up their behinds about a nonexistent "recovery."

And they believe in brokers and advisors who say, "Hang in there and ride it out!"

And they believe the media's rosy rhetoric about "job growth" and "housing starts" and other such election-year hype...

Why do people buy into all this rubbish – when their wallets and retirement statements paint a very different picture?

It's because deep in their hearts, they hold out a desperate hope that buying and selling stocks will make them rich, like it did in the '80s.

Now, I'm not saying it couldn't do that. Someday.

But what I am saying is that by my own rigorous calculations – and I'm going to show you the hard-numbers proof in just a moment...

The Dow and S&P literally CANNOT have a real bull run for at least 9 years.

Until then (and maybe much longer), they'll be stuck in a coma – along with every American investment portfolio that's relying on them!

But before I get into all the scary proof (and it's very scary indeed), I want to reassure you that no matter what the Dow and the U.S. economy do...

I've got a strategy that could make you stunning money not just over the next nine years of "market coma" – but for the rest of your life.

Using this simple strategy, you could:

- Create an income stream for yourself of $1,000… $5,000… even $10,000 or more every month, for life, depending on your commitment and wherewithal to use this method. It's entirely up to you. How much money do you want to make?

- Actually DOUBLE THE INCOME I mention above with one simple move. That's right, double the income I've just shown you.

- Retire by increasing your net worth by as much as 350%, or more, as you'll see…

I'll be honest, it's not easy. But it can be done – once you learn the "cash harvesting" method I've developed.

Now, over the next few minutes, I promise to give you all the details on this novel moneymaking strategy.

First, though, let me show you exactly why you're going to need it.

The money pundits in the press and on TV are gleefully reporting that the blue chips are up over 13,000. They seem to be saying, "Happy days are here again!"

But they're completely wrong.

That's because the REAL Dow number – meaning the one that actually reflects the U.S. economy...

Is right around 8,800 right now.

Yes, that's right: America's stock market is artificially inflated by a whopping 50%.

This may be one of the scariest realities facing people today. So listen closely:

There's a reason this happened – and it's something I want you to remember:

It's because the U.S. government has intentionally decoupled the stock market from the economy.

That is, the connection between the stock market and the U.S. economy has been erased. Obliterated. And that's a problem. A big problem.

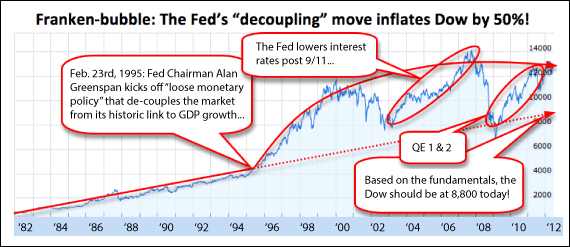

I can pinpoint the precise moment this "decoupling" began – February 23rd, 1995, at the Federal Reserve's bi-annual Monetary Policy Report to Congress.

That's when Fed Chairman Alan Greenspan first suggested the loose monetary policy that has stolen the American dream from so many investors.

This abrupt reversal of policy spurred an immediate rally in stocks. And overnight, an unthinkable precedent was put into effect.

The Fed's policies could now be used to pump up the market – not strictly as an emergency measure in response to a national crisis...

But just because.

This opened the floodgates to Quantitative Easing, money printing, interest rate manipulation, and other "stimulus" shenanigans that have become The Fed's MO over the last 17 years.

The result: An artificially engineered "Franken-bubble" unlike any in U.S. history.

You can see it in this chart…

|

When the stock market goes down, The Fed adjusts monetary policy to jack it up again!

Remember what happened after 9/11? Greenspan cut interest rates to stimulate the economy, creating the housing bubble…

Which caused the "crash" of 2008 – which as you can see, was really just the market reverting to its fundamental economic value.

But since we can't have huge fake asset bubbles bankrupting mega-banks, mortgage giants, and huge multi-national corporations…

The Fed swung into action once again – with Quantitative Easing, money supply expansion, interest rate suppression, and "twisted" treasury buybacks.

And the market jumped back up, starting in 2009.

However, before The Fed started manipulating the market in February of 1995, the Dow and S&P 500 accurately reflected America's economic growth. The following facts plainly show this...

Since 1947, the U.S. GDP has grown by an average of 3.3% annually, with an average inflation rate of 3.4%. That's a combined 6.7%.

At the end of '47, the Dow sat at 177.58. Multiply this by 6.7% – compounded annually through 1994 (47 years) – and you'll get 3,742.

That's almost dead-on the 3,793 reading the Dow posted at the close of '94!

However, since February of 1995, America's average yearly inflation rate has been 2.48%. And the average annual GDP growth has been only 2.38%.

That's a combined 4.86%. Which means that if the historic relationship between GDP growth, inflation and the stock market had held true after 1994…

The Dow would've closed the second quarter of 2012 at 8,808!

A recent report from the Federal Reserve Bank of New York proves that my calculations are accurate. According to that July 11th report…

As much as 50% of the S&P 500's gains since 1994 are due to market reactions to Fed monetary policy announcements!

Bottom line: There are two critically important things you need to know if you want to actually make any money in the comatose, Franken-bubble market we're facing...

| ONE: The Fed's "market cocaine" is losing its pop – The effectiveness of Quantitative Easing (QE) and other stimulus at pumping up equities is diminishing fast. For instance, QE2 expended 50% more stimulus cash for every point it raised the Dow, compared to QE1. And The Fed's "Operation Twist" is costing even more per market point than did QE2. I fully expect this next round of stimulus from the Fed to do even less. And those who get caught in it could have a big price to pay. TWO: The economy won't "re-couple" with stocks until 2021 – Eventually, today's hyper-inflated stock market will reconcile with the rock-hard realities of the U.S. economy. It's simple economic physics. So, let's say that for the foreseeable future, the U.S. economy posts a modest 2% annual growth, and 3% annual inflation. Using the same formula that held true from 1947 until the market's 1995 "decoupling" from the economy... It'll be nine years before the real economic fundamentals catch up to where the market is today! |

For at least nine more years, we can expect a "comatose" stock market – flat overall, with occasional spikes and drops of volatility.

And that's only IF the U.S. economy grows at 2% annually!

Right now, there's very little evidence to suggest that the U.S. economy is capable of growing at a 2% annual rate for the foreseeable future.

Morgan Stanley just revised its forecast for America's GDP growth in 2013 downward – to 1.75%, from this year's 2% growth estimate...

They also issued a warning that because of the unavoidable "fiscal cliff" of tax hikes and spending cuts, the U.S. GDP could get a lot lower after 2013.

But even this gloomy forecast could be extremely optimistic.

A recent study from the renowned Robert Gordon at Northwestern University shows that America's economic growth may have ended completely...

This study shows how the U.S. GDP doubled in just 28 years between 1929 and 1957. And it doubled again in the 30 years between 1958 and 1988...

Yet in the very best scenario today, the American standard of living could take more than a century to double again.

That's an annual growth rate of just 7/10ths of 1%.

If you're like most people, and you've been invested in the market for the past decade, you now know why you haven't made a penny.

And that gets us to the part where I show you how to actually make real money against this disturbing backdrop.

The first thing you need to do is...

and "the economy"

Yes, you heard me right.

If you want to make money over the next nine years...

You've got to stop worrying about stock market gains. That's a little counter-intuitive, I know. And for 99% of investors, it'll be impossible to do.

That's because we've been programmed for years to buy stocks – believing that we'll be able to sell them later at a higher price.

But as you've seen, that may not happen again for a very long time. If ever.

So what CAN you do to make any kind of decent money in this situation? Something that's lasting and certain?

Well, as I'll show you over the next few minutes, you could:

- "Harvest" thousands of dollars from the market every month– instead of gambling away your retirement on this laughable idea of growth…

- Tap into the hidden force responsible for 90% of the stock market's returns over the last 73 years (and it isn't share appreciation)…

- Use a zero-down technique for the chance to turn your gains into quick massive income "pops" – that's right, for zero additional cost.

And not to brag, but I know just about every way to make money – in any market. That's because I've been around the block a time or two over the last three decades.

In fact, I've pretty much done it all when it comes to making money.

And I've done it not just in London and New York – but throughout all the major hubs of international finance in Europe and Asia.

Aside from my graduate degree from Harvard, I've:

- Managed major global investment banking operations – I've done arbitrage, managed bond issues, overseen currency swaps and more for major banks in Europe, Asia, and New York.

- Served as an international financial strategy consultant – I've been hired to advise all kinds of clients in every corner of the globe: Korea, Spain, Europe, the U.S., Asia, and more.

- Advised foreign countries for the U.S. Department of the Treasury – At the request of the U.S. and other local governments, I've helped shape fiscal policy in Croatia, Slovenia, Macedonia, Bulgaria and others.

- Regularly published in high-circulation forums – Including the Wall Street Journal, the New York Times, Washington Times, American Spectator, Reuters, UPI and many more.

- Served as a Business and Economics Editor for UPI – I set up and ran correspondent networks in Asia, Europe, and Latin America.

Now, before you think I've let it all go to my head, let me assure you that I mention all of these things not to boast...

But to prove that virtually no one else can show you the harsh reality of market economics like I can.

This means I'm also in a rare position to help you turn these brutal conditions to your financial advantage!

And I want to get started doing that for you right now...

13 times as much money as typical

income investments would pay you

I sincerely do believe that in a comatose, Franken-bubble market – like what I'm certain beyond any doubt we'll see for the next nine years at least…

Dividends represent the biggest source of returns you can get from stock investing.

Now, to a lot of people, dividends may not sound very sexy.

That's because they don't realize that 90% of the U.S. stock market's returns over the last century have come NOT from share appreciation…

But from the cash that companies pay their shareholders.

When you think about this, it's like having the thousands of people employed by these dividend-paying companies all working to make you rich...

Let me walk you through a quick example of the power dividends can hold...

R.R. Donnelly and Sons (RRD) is an American company that provides printing, packaging, and digital communications solutions for clients around the world.

But like a lot of perfectly solid companies, RRD shares are trading right now at about the same price as they were in late 2008!

So yeah, people who've held this stock for the last four years have made virtually nothing…

At least, that's what the less educated think.

For this entire time, R.R. Donnelly has paid out a large portion of its profits as a yearly dividend of $1.04 a share.

Based on today's share price of around $11, this would be a roughly a 9.5% annual return.

Can you think of anything else that's reliably paying 9.5% per year on your money right now?

|

Savings accounts aren't much better, at about 1% for the best of them...

Now, I'll take a return like that any day of the week.

But how do you know you'll get your money… every quarter… like clockwork? Year after year?

In a moment, you'll see something amazing, never before revealed, that shows you the answer to this question with near absolute certainty.

And what if I were to show you an advanced technique that could take that 9.5% dividend and juice it up by 30%, 40%, 50%? Even over 100%, as you'll see…

That's right. A 100% return on just one simple move that you can make in a less than a minute. Stay tuned. You're going to see this.

Now, if that doesn't sound like a godsend in today's market, then I suggest you click out of this report right now.

And let me be clear about something: I'm not saying you should run out and plunk your retirement savings into R.R. Donnelly stock.

I just used that company as an example of how you can and absolutely MUST stop focusing on share appreciation...

And start looking at shares as a means of "harvesting" income from the market.

The money's just sitting there in corporate accounts – growing every day through interest and business profits. Like grass in a field...

And you own a license to regularly cut some of this hay for yourself!

That's what I mean when I talk about "cash harvesting."

By now, I'm sure you can see why it's a total no-brainer.

Especially if you've got ME recommending the crème-de-la-crème of dividend-paying companies to you – and also showing you how you could juice those dividends by 30%, 40% even 50% or more.

But beware: Not just any old company with a hefty dividend is good enough to trust your nest egg to.

In fact, the vast majority of "high yield" dividend stocks are total rubbish. And many of them can cost you your shirt faster than a craps game.

So what's my secret to picking the best and safest income plays?

I call it the "Certainty Index." It's a one-of-a-kind method I've developed for systematically choosing safe, extremely high-yielding investment opportunities…

And eliminating high-risk stocks – even those that don't appear to be high risk.

Now, I've never shown my "Certainty Index" to a soul before in my life.

But right now, I'm going to unveil it for the very first time...

To YOU.

and actually BEAT the market's "coma"

Sure, there are companies on the market paying upwards of 24% in annual dividends right now. I see them pop up, especially in advertising for newsletters and other services.

But they're not businesses you'd want to buy into.

Let me repeat that. Every dividend I've ever scrutinized paying 18%... 19%... 20%... even 24% are total rubbish. You will not make a penny on them.

Look, I hate to burst anyone's bubble on this… but come on. If it sounds too good to be true, well, it's too good to be true.

Read my lips. Any business that has to cough up a quarter of its share price as an incentive to buy its shares is hiding some major elephants in its closet.

Elephants that can stomp your money into dust in no time flat.

And the biggest scam in this mess works like this: You may get paid a dividend (for a while), but you can kiss your original investment goodbye!

Thing is, there are a number of sound, stable, and growing companies that generate reliable dividends of even as much as 10-13%.

Not a lot of them, mind you.

But enough that if you know what you're doing, it would be relatively simple to "harvest" yourself up to $1,000… $5,000… $10,000 a month in extra income from them, depending on your commitment...

That can have practically as much safety as a U.S. government-guaranteed Treasury Note!

If you take me up on what I'm offering you today, I'm going to show you how I find these. Let me walk you through an example of how I do this right now.

I do it using what I call my "Certainty Index."

I developed this tool to assess whether companies are suitable to recommend as part of my market research service (called Permanent Wealth Investor).

Let me give you just one snapshot of how my Certainty Index works.

I'll use Short-term Certainty as an example. That is, how you'll know whether or not you'll even get your cash for the next quarter OR THE NEXT YEAR.

(After all, how many times have you gotten suckered into a one-time dividend?)

Short-term Certainty – Like I said, this is the probability that a company's dividends will continue at their current level – or in many cases, higher – for the next 12 months.

Basically, how I do this is to assign a letter grade to each of five factors that influence a company's ability to pay dividends in the short term. Then I compute these into a weighted average formula with a final grade on a 10-point scale.

The five weighted criteria I use to make this determination are:

- Ratio of Earnings to Dividends Paid (35%)

- Ratio of Cash Reserves to Dividends Paid (20%)

- Historic Variability of Quarterly Earnings (20%)

- Risk of Upsets to Business Model (15%)

- Past Persistence of Dividends (10%)

Let me show you how it works by applying it to another American blue chip, Emerson Electric (EMR). Here it goes...

| Ratio of Earnings to Dividends Paid (35% of score) – EMR's in great shape here, with per-share earnings 2.6 times higher than last quarter's dividend (anything 2X or over is super-solid). GRADE: A Ratio of Cash Reserves to Dividends Paid (20% of score) – EMR's a sound position here, too, with cash reserves ($2.29 billion) of more than 7.8 times its last dividend payment of $293 million. GRADE: B Historic Variability of Quarterly Earnings (20% of score) – EMR's earnings over the last year show a fairly tight dispersion from $371 million to $770 million, with a consistent uptrend over the last three quarters. GRADE: A Risk of Upsets to Business Model (15% of score) – Being old, diversified, global, and aggressive in R&D, EMR's got excellent insulation from threats to its business, both from competitors and from changes in technology. GRADE: A Past Persistence of Dividends (10% of score) – Emerson's stellar in this department, having raised its dividends every one of the last 21 years, with a total increase of 1,259% per share. GRADE: A+ |

EMR scores an impressive 9.7 out of a possible 10 points.

In other words: My research indicates that they've got a 97% chance of continuing to pay their current level of dividend, or more, for at least the next 12 months.

That's as safe as Treasury Notes!

Now, let's take a quick look at another stock – one a lot of investors might be attracted to because of its historically high dividend yield of 9% - 14%...

But according to my Certainty Index, it's one you should steer well clear of.

It's a large company that offers voice, broadband, wireless Internet, data security and other services for small businesses and home offices across 27 states.

Sounds impressive, yes?

Lots of ordinary people think so, too. It's very popular among everyday income investors. Yet their odds of making money are low.

Here's how it stacks up to my Index, in terms of short-term certainty...

| Ratio of Earnings to Dividends Paid (35% of score) – Its earnings are a roughly a quarter of its dividends, with earnings of 10 cents a share over the last four quarters against annual dividends of 40 cents. GRADE: D Ratio of Cash Reserves to Dividends Paid (20% of score) – The company is in marginal shape in this regard, with $421 million in cash on hand vs. quarterly dividends of $96 million (a 4.3X multiple). GRADE: C Historic Variability of Quarterly Earnings (20% of score) – Its earnings have been stable, ranging from $42 million to a lackluster $17 million last quarter, but are far lower tham their $96 million-per-quarter dividends. GRADE: D Risk of Upsets to Business Model (15% of score) – This company's got troubles in this department, with the bedrock landline segment of its business clearly being cannibalized by the explosion of smart phones and tablets. GRADE: D Past Persistence of Dividends (10% of score) – It doesn't even warrant a grade in this category. Two years ago, they paid yearly dividends of $1.00 a share, while today they're paying only 40 cents. A telling trend. GRADE: 0 |

Clearly, this is well below my "marginal" rating of between 40 and 60.

Now remember, this is just one aspect of my one-of-a-kind "Certainty Index." I can use similar calculations to determine, with a high degree of certainty:

- A company's chances of paying their current dividend (or increasing it) over the long term – up to five years out…

- A company's risk of takeover – and whether that means you should bail out before the deal, or load up on shares…

- Whether or not a stock's options are likely to expire worthless – or make you a fast triple-digit win...

And as I said before, I've never revealed it to anyone. Ever.

Why not?

Because it's the secret that has made in-the-know investors extremely rich...

And led readers of my Permanent Wealth Investor to incredible gains… The kind of wins that have them writing in to say things like:

| "The Permanent Wealth [model] portfolio has been, to say the least, an 'enriching' experience. The capital gains and juicy dividends have made a believer out of me. I recommend it to anyone who needs steady income with growth, or growth with income, either way." – M. Cowen, Seattle, WA "I just wanted to say, 'Thank You!' for... the 85.9% gain I realized... Your Permanent Wealth Investor [research] service is absolutely outstanding... I couldn't be happier that you have so honored the trust and faith I put in you." – M. Michalski, Boulder, CO "I felt I had to email you to say how delighted and staggered I am at the additional $9,100... It is by far the largest payout I have ever received for holding 400 shares of a company, and that is on top of the already received amount of $3,804.76." – W. Aspen, Branson, MO |

All of which are testaments to the incredible power of the Certainty Index I've spent 30 years developing!

And remember, with this report today, I'm offering this one-of-a-kind moneymaking tool to you – 100% FREE OF CHARGE.

Yes, I'll show you exactly how to get this in just a moment.

First, though, I want to show you what separates the Permanent Wealth Investor from anything else out there.

It's the difference between making great money – and unbelievable money. Money that will have you dancing in the streets… crying with joy… and thanking your lucky stars.

Yes, it's that good…

to your "cash harvest"

If you're like most Americans, you may not have even 10 years left until the day you'd dreamed of retiring...

That's why INCREASING YOUR GAINS from dividends is one of the cornerstones of my Permanent Wealth Investor research service.

Here are four ways to do this right now:

#1: JUMP START YOUR GAINS – If you time your purchases right, you could give your income investments an immediate boost. Let's say you're eyeing up a stock that currently pays a dividend equal to 12% of its share price, paid quarterly...

If you time your purchase to get in just before what's called the "ex dividend" date, you'll pocket that first 3% quarterly dividend payment in mere days. This gives you a nice head start on your "cash harvest," kind of like fast-acting fertilizer.

#2: MAGNIFY YOUR INCOME – The likelihood that a company will increase its dividend payments in the future is a critical factor in my evaluation of an investment recommendation.

Most of the companies I'll recommend have increased their dividends for at least 30 years, regardless of what the market has done.

And using my "Certainty Index" and other tools, I'm going to make sure they have the fundamental soundness to keep doing it, so you'll bank more and more income over time.

Here are a few examples of aggressive corporate dividend increases over the last 20 years:

- Healthcare giant Johnson & Johnson: a 961% dividend increase…

- Consumer-goods conglomerate Procter and Gamble: a 717% dividend increase…

- Food processing and commodities player Archer Daniels Midland: a 1,616% dividend increase…

- Home Improvement superstar Lowe's Companies: An incredible 3,536% dividend increase…

#3: MULTIPLY YOUR HOLDINGS – Many of the quality companies I recommend have Reinvestment Programs. These allow you to use dividend income to purchase additional shares of stock commission-free and at a significant discount over the market price.

By itself, dividend reinvestment can double your money in a surprisingly short time. For instance, if you'd invested $1,000 in the S&P 500 in 1929, you'd have had $51,311 by the beginning of this year, based on share appreciation alone.

However, just by allowing the dividends to reinvest, your original grand would have multiplied into an incredible $1,328,000.

That's over 1,328 times your money over this same time period. So you can see how fast your money would have simply doubled.

Let's look at this another way real quick: If shares in the previously mentioned R.R. Donnelly and Sons were to stay at roughly the same level for the foreseeable future (like I think the entire stock market is going to)...

Reinvesting their dividends would double your safe money in just seven years!

#4: WRITE A CONTRACT AND DOUBLE YOUR INCOME – One way to boost returns from dividend investments is to write a contract on them. That right. Few people realize this, but you can write a contract on your shares to sell them at a much higher price. And guess what, you collect a hefty premium for this.

In fact, you could collect this premium over and over again, without ever buying, selling, or owning additional shares of stocks at all.

Folks, this is HUGE. And there is no additional cost.

If you've never done this before (and not many people have), DON'T WORRY. I'll be showing you the technique and how to use it in great detail. And it's incredibly simple and easy as pie to execute.

Here's a great example of how this strategy works:

American tobacco giant Altria Group (NYSE: MO) currently pays a dividend of around 4.9% of its share price, and trades for $33.96.

Now, if you were to write a $34 December "call" on this stock, you'd be paid a premium of $1.21, around 3.5% of the share price...

But by the time a December contract would likely be exercised, MO should shell out two dividend payments. So that's another 2.45% on your money. Add it all up and you've made 5.95% on your money in four months.

Depending on the premium you collect, you could score 11.9% or more in 12 months–from an initial dividend of 4.9%!

That's over double the income.

You can do this as many times as you like, period after period.

Now this is a truly an advanced income strategy… something that few people know how to do. And like I said, I can show you how to take advantage of it yourself, step by step, in plain English.

And occasionally, you can nail a BIG win on one of these contracts.

Earlier this year, in fact, I showed readers of my investment research service, Permanent Wealth Investor, a winning recommendation of over 137% on a February contract on B&G Foods. And that's not the biggest windfall I've shown my readers, either.

My point with everything I've shown you so far is this: I can teach you lots of ways to "harvest" cash from the market…

None of which depend on share appreciation!

And as I've shown you, that's going to be critical over the next nine years of a "comatose" stock market.

OK, let's get down to brass tacks...

And to the part where you make a lot of money. Ready?

you through the "market coma"

of the next nine years

It takes sizeable gains to provide you with a strong source of monthly income and a secure, comfortable retirement...

That's why my Permanent Wealth Investor focuses only on plays that have the likelihood of paying off BIG for you.

I've run this research service since 2009 for Money Map Press in Baltimore – one of the nation's fastest-growing publishers of investment research.

And over that time, I've used my "Certainty Index" and other tools to rack up:

- Average gains of 19.4% last year, in 2011 equity recommendations alone (not including advanced income techniques). That's the AVERAGE gain of every equity and dividend-paying position in the model portfolio. I'll stack this up against any track record in existence… growth, commodities, technology, you name it…

- Individual wins of 69%, 85%, 144%, 150% – even as much 342% on advanced income techniques…

- A stunning win percentage of over 87% on open equity positions (not even including advanced income techniques) for 2012, with gains adding up in a year with the potential to surpass 2011.

- Remember, even a 15% annual gain on your money (without juicing your income one iota) could DOUBLE YOUR MONEY IN 4.8 YEARS…

That's not even including winning recommendations of up to 342% in four months, which I've been able to nail for my readers using well-chosen timing and income techniques...

Bottom line, it's all about:

- Consistency and certainty…

- Not getting taken to the cleaners on "fake" dividends…

- Choosing companies with increasing dividends…

- Combining techniques that I can show to take your income to dizzying heights… So that you have the opportunity to double your net worth in under 5 years… and increase it more 350% after that…

Not only does it look for the biggest, highest-yielding (and safest) income you can possibly "harvest" from the market...

But you can also learn how to DOUBLE your income, year in and year out.

OK, let's cut to the chase here. The most convincing statement I can make to you about the power of my Permanent Wealth Investor...

More than the research service's track record of gains – or letters from grateful readers...

Is the simple fact that the principles and techniques you'll learn in Permanent Wealth Investor could help you build a life most people would envy.

For myself, I dine regularly at the swank Harvard Club in Manhattan...

I've travelled the world over for both business and pleasure...

And I live the good life in my century-old, slate-roofed Stickley home in one of New York's most prestigious, historic neighborhoods.

I've come a long way from very humble beginnings.

And you could do the exact same thing. Using the techniques you've just learned, you could literally start now – and have the chance to be comfortably retired in just a few short years.

You don't need a Harvard MBA like mine to do it, either.

Nor do you need to chain yourself to the computer round-the-clock.

All you need to do is join my Permanent Wealth Investor research service. I've made that incredibly easy for you...

And totally RISK FREE. Here's how you can do that right now.

for the rich or naïve

My publisher at Money Map Press believes we should charge at least $1,995 a year for the Permanent Wealth Investor.

After all, that's the full-list price we've been charging for the research service since its inception in 2009 – with no shortage of satisfied customers.

So for the record, I think $1,995 a year would be a ridiculously low price to pay for the "cash harvesting" tools I'm going to give you.

Heck, the Certainty Index alone has got to be worth 10 times this amount, if I had to put a value on it.

Yet I've made an arrangement with my publisher that will allow me to give you everything that Permanent Wealth Investor offers...

For a fraction of the $1,995-a-year retail price.

I'll give you the specifics on that unprecedented offer in a moment. First, let me show you everything you'll get when you sign up:

- Weekly Alerts – My recommendations are specially selected using my Certainty Index to be safe, lucrative, and pay out sizeable amounts of income. And you'll get advanced income techniques with the very real opportunity to double your gains, even in this comatose market of the next nine years. And this weekly report is where you'll find everything, , plus updates on the model portfolio picks, protection moves, and a lot more.

- Training Seminars – Every six weeks, you're invited to attend one of my seminars. This is where you get my lessons on how to become a master income achiever. You'll receive my PowerPoint lesson in advance, and then I'll walk you through every step of becoming a true income guru over the phone, with other subscribers. And you don't pay one additional penny for this benefit!

I'll walk you and readers like you through how to choose solid dividends on your own, and make sure you're not getting scammed on fake dividends. After that, you'll get lessons on dividend timing… and advanced techniques like the contracts I mentioned. [As with all financial training, no personal questions or advice can be accepted.]

- Special White Papers – Once you sign up, you'll be able to access and download a number of straightforward reports I've written (and continue to write) about how to "harvest" a sizeable and accelerating monthly income from the markets. The first of these, my Certainty Index Overview is yours immediately upon sign-up.

- 24/7 Web Resource Access – Once you sign up, every single component of my Permanent Wealth Investor will be available to you around the clock, via our password-protected Web site: My one-of-a-kind "Certainty Index," archives of my monthly issues and weekly Alerts, Special White Papers, the up-to-the-minute research service's model portfolio, conference call recordings, and so much more.

When you factor all this in, my Permanent Wealth Investor would be a value that borders on the blasphemous – even at $1,995 a year.

But again, you won't pay anywhere near this much...

And just to make sure the decision to try my research service is a complete no-brainer for you, I've made it ZERO RISK!

Take a look at this:

|

OK, now that you're covered for a full 90 days...

If you're not ready to go right now, you're either independently wealthy – or blindly optimistic about the prospects of the U.S. economy and stock market.

However, if you're not rich or naïve, let me shock you right now with how reasonably I can get you into my Permanent Wealth Investor research service...

But only for a limited time.

Permanent Wealth Investor has to offer –

but only for a short time

If you take nothing more away from this report...

Even if you don't end up subscribing, risk free, to Permanent Wealth Investor...

Let this one thing stay with you: I honestly believe that from a financial standpoint, the next nine years will be the most trying in U.S. history.

It will truly be a contest between the free market and those who would manipulate it for political purposes...

With no less at stake than the nation's economic soul.

I also believe that there's ONLY ONE WAY to make any kind of real money in the American stock market for the foreseeable, comatose future...

That's to "harvest" income –huge income–from dividends… Then explode those returns with proven, risk-controlled strategies.

My Permanent Wealth Investor research service can help you do all of these things.

I really hope you take me up on my offer today. Because there are going to be a lot of miserable, broke people in America very soon.

And I honestly don't want you to be one of them.

Seriously, all guaranteeing and offer-making aside...

The biggest reason I'm talking to you right now is because I can't just stand idly by and let people get screwed for believing in the American Dream.

Because that's exactly what's going to happen – in fact, it's already happening.

People want to believe in the venerable U.S. stock market. They want to feather their nests the way their fathers and grandfathers did...

But as sad as it is to say, these folks need to be disabused of this romantic notion. Or else they're going to end up broke.

So that's why I put this report together...

Why I decided to finally release the Certainty Index I've guarded so jealously over the last 30 years...

And why I've pushed so hard to lower the price of Permanent Wealth Investor...

To just $850 a year!

I firmly believe, right now, that you're going to be one of the many folks who write in to tell me how much money my research service has helped you make…

In what I foresee as the toughest nine-year stretch in history for American investors.

But to do this, I need you to take the first step – and sign up for my Permanent Wealth Investor research service right now...

With a full 90-day "any reason" money-back guarantee, there's no risk at all to you.

And for only $850 a year – less than your cable TV bill, I'll wager – there's no good reason NOT to give my research service a try.

It would be worth the effort a thousand times over to get my never-before-seen Certainty Index.

With a little practice, you really could use that one-of-a-kind investing tool to "harvest" $1,000… $5,000… $10,000 a month or more from the market...

Or increase your net worth by up to 350% or more. All by yourself.

A word of warning, though: Money Map Press is not exactly thrilled at the prospect of me practically giving Permanent Wealth Investor away to a large number of new subscribers.

Especially since it's clearly worth a lot of money – even more so with the addition of my Certainty Index to the bargain.

Therein lies the catch to this deal:

My publisher told me in no uncertain terms that I'm only allowed to make this special offer to you for a very limited time.

And he wouldn't let me pin him down on what "limited time" means.

Literally, the price could go back up to $1,995 a year or more at any time. Like tomorrow. It's solely up to him – I have no say in the matter...

So you'd be wise to act now. It may be the only chance you'll ever get to sign up for Permanent Wealth Investor at more than 57% OFF the regular price.

To take me up on this offer and sign up, risk free, for Permanent Wealth Investor...

All you need to do is click on "subscribe now" right here, or at the end of this letter.

Or, if you'd prefer, you can call 855-509-6600 or 410-622-3004 (for international callers) between 9AM and 5PM ET and mention priority code WPBINA00.

But whichever sign-up option you choose, you should do it NOW – while you've still got a chance to reap all the benefits for next to nothing...

Happy Harvesting,

Martin Hutchinson,

Founding Editor, Permanent Wealth Investor

September, 2012

P.S. You've now seen the hard-numbers proof that the U.S. stock market is looking at a sustained "comatose" period while it re-couples with its historic relationship to the economy. The Fed can't pump it up forever. So what are you waiting for. Act right now if you want:

- Consistency and certainty in the biggest, safest dividends you ever likely to get in your life…

- No getting taken to the cleaners on "fake" dividends…

- Companies paying out increasing dividends, year after year…

- Special training for my subscribers to teach you techniques to explode your income by 100%…